What puzzles me about Drum is that it’s so easy to find and use the relevant data. He must think his readers are pure idiots. And I guess he’s right. For instance, this article uses relevant data.

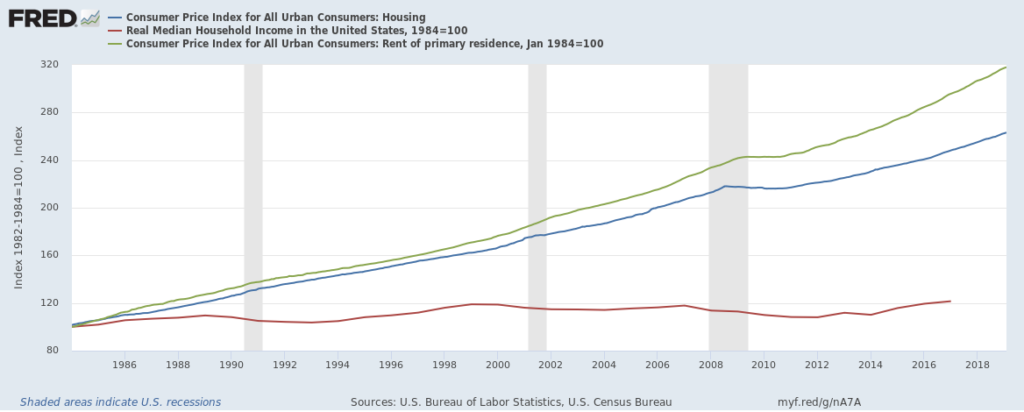

They find that “inflation-adjusted rents have increased by ~64% since 1960.” This is less than I’d found, but then again it matters how you examine the data (and where you look). And:

Next, we looked at cost-burden rates by household income quintile. Renters with incomes in the lowest 20% have had cost-burden rates greater than 70% since the 1970s, and affordability has continued to decline in recent years. Among renters in the lower middle bracket (making up to $41,186 a year), however, the increase in cost-burden rates has been significant, with an increase of 22% since the year 2000. Renters in other income brackets have fared better, but cost-burden rates have risen across the board.

Drum is not an expert on anything (and it shows), but people treat him like one. And he’s smart enough to dupe his readers with pretty graphs that look correct but contain misapplied or misunderstood data. That’s what makes him so rhetorically dangerous.

This article is also decent.

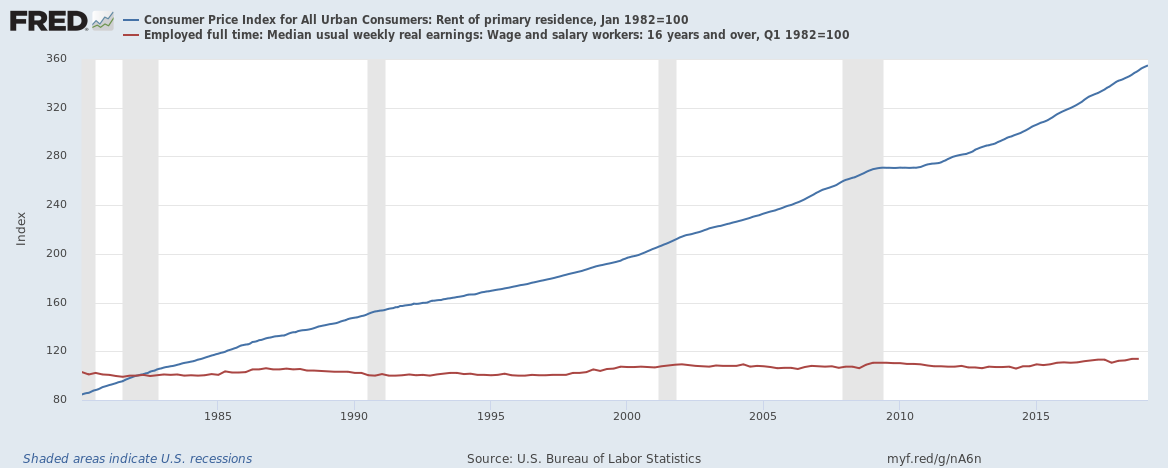

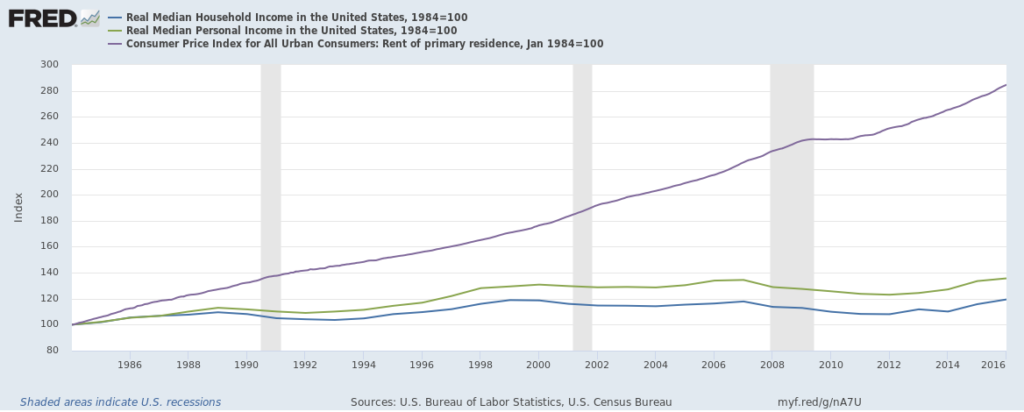

After I attempted to reproduce Drum’s data and could not, I finally figured out one of the tricks Drum pulled on his first graph, the one that compares rent of primary residence to median income. He’s using median family income and not median household income. Median family income only includes people who are related to one another and does not include anyone living alone (about 25% of the population). The difference, obviously, is significant. Because it changes the composition so much it means that median family income is about 30% higher than median household income, which is mostly enough to erase the very obvious and occurring-in-the-real-world divergence of rent from median income.

Needless to say, median household income is more relevant and more broad than Drum’s bullshit use of median family income (a trick he has pulled before). Using median family income is severely misleading for a whole host of reasons.

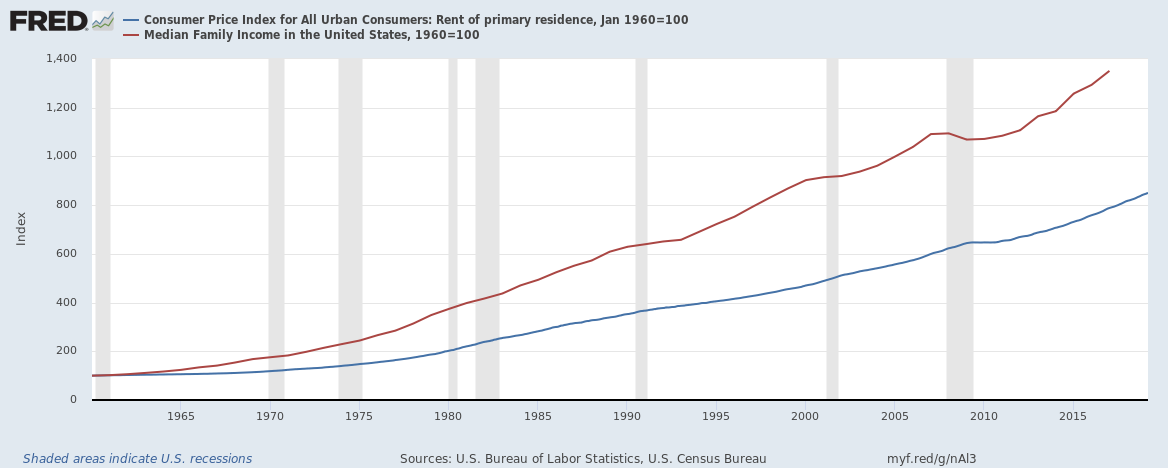

Here’s the two compared. First, Drum’s BS data, using family income:

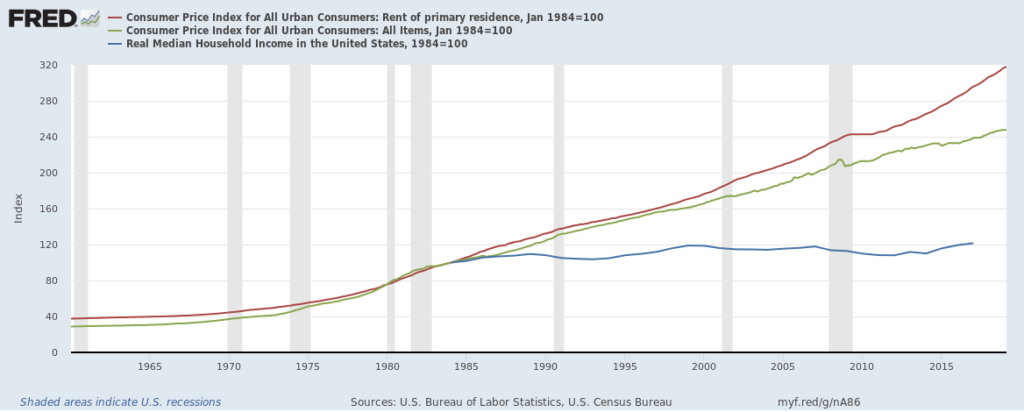

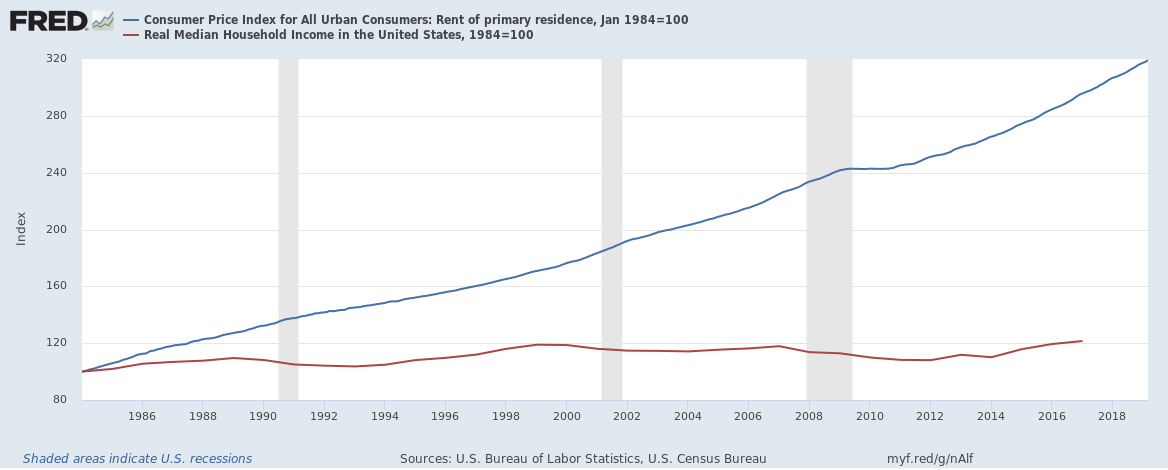

And here’s household income, the better measure (unfortunately this latter series only starts in 1984):

Turns out you can get a lot of mileage out of mis-examining data. Drum does it frequently, and it does take some digging to figure out how he does it, exactly.