Here goes fucking Kevin Drum again. Claims that “Millennial Debt Is Actually Quite Low.”

Let’s do some basic thinking here — something Drum seems absolutely incapable of. Say you have a certain amount of income. Only so much of it can go to debt servicing, because you still need to pay rent, for health care, for food.

What happens when your debt composition changes dramatically to student loans over time, while for those without a college education, incomes are falling? And it also happens that the necessities of life such as housing, health care and education are getting vastly more expensive. Meanwhile, student debt takes up a large portion of the millennial possible debt vs. income ratio.

The average student loan debt per borrower in 1989 — when boomers were in their 20s and 30s — was less than $2,000, according to the Urban Institute. In 2015-16, bachelor’s degree recipients who borrowed money graduated with an average of $28,400 in student loan debt, according to the College Board.

More than 40% of millennials report having student loan debt compared with 13% of boomers, according to a study by Aon Hewitt.

(I am not sure if the 1989 number is inflation-adjusted or not. I think it probably is.)

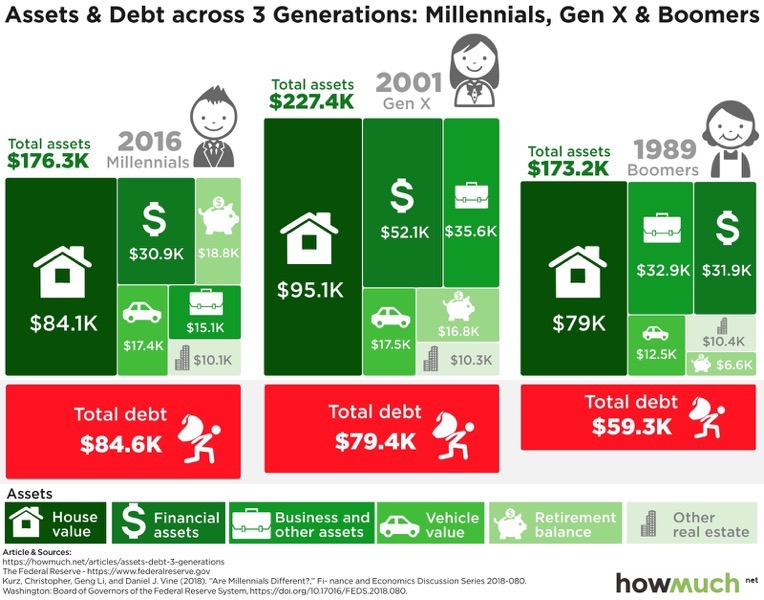

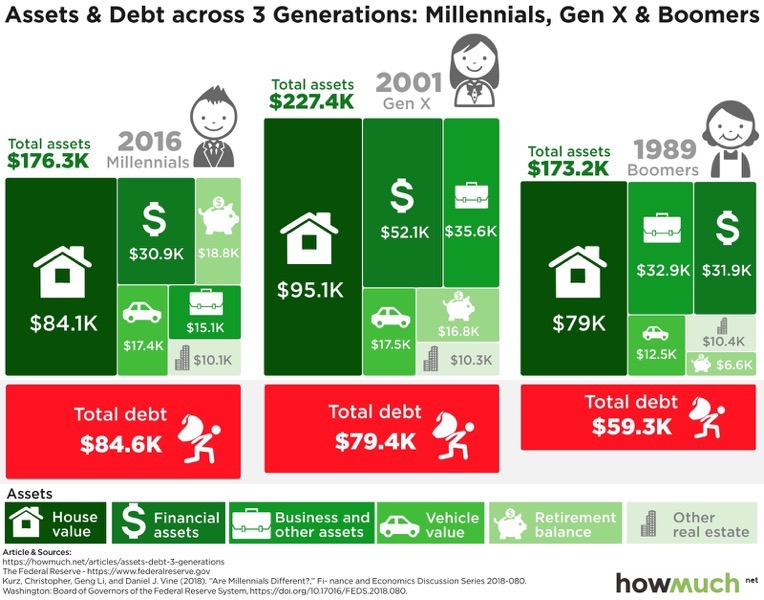

And then, for instance, you end up with something like this:

Also, “Millennials are $1 trillion in debt — more than any other generation in history.” The headline is a bit sensationalist, but it’s not wrong.

Also:

A study from the Federal Reserve Board has found that “the average student loan balance for millennials in 2017 was more than double the average loan balance for Generation X members in 2004.”

This, it was far more than the Baby Boomer’s student loans (about three times). That’s, of course, going back to debt composition and debt servicing we were considering a bit prior. Also, to address a variety of Drum’s stupid-ass points, check out this Fed Report that fucking Drum should read rather than skimming worthless graphs. And I quote:

We showed that millennials do have lower real incomes than members of earlier generations when they were at similar ages, and millennials also appear to have accumulated fewer assets. The comparisons for debt are somewhat mixed, but it seems fair to conclude that millennials have levels of real debt that are about the same as those of members of Generation X when they were young and more than those of the baby boomers. These balance sheet comparisons likely reflect, in part, the unfavorable labor and credit markets conditions that prevailed during the 2007–09 recession, some of which had prolonged effects.

That must be considered, as I mentioned earlier, vs. composition of both expenses and debt. Thus, While incomes have increased for millennials, many significant economic expenses, such as the cost of buying a home and college tuition, have increased at a faster rate.

Also, here’s some more relevant info:

Key study takeaways

Rent costs: Millennials pay the highest rents when entering the workforce, with a 2017 average of $1,358. By comparison, Gen-Xers paid just $850 (in today’s dollars) in rent per month at the same life stage, and the Silent Generation paid under $500.

Homeownership: Millennials buying their first homes today will pay 39% more than baby boomers taking the same step in the 1980s.

Getting a degree: When millennials were born, tuition at public 4-year colleges was just $3,190 per year (adjusted for inflation). By the time they grew up and enrolled in college, tuition rose 213% to today’s cost of $9,970 per year.

Earning more: Millennials and other generations have benefitted from a 67% rise in wages since 1970. However, these gains have not been enough to keep up with ever-inflating living costs. Rent, home prices, and college costs have all increased faster than incomes in the U.S.

I don’t know what Drum’s problem is — deeply afraid of change and his house price falling a bit, I’d guess. Still, why lie? Why distort so much that is obvious, when valid information is easy to find? It’s a waste of everyone’s time and perhaps that’s the point. The more chaff you can spew the less chance anything has of changing.

As for me, I guess I will keep taking this doofus down until it’s not fun anymore.