The problem with economics — related to 90% of it being bunk — is that you have to check every little statement assiduously for error. Especially if they are from the University of Chicago, for instance. I read the paper, too, but the interview is easier to write about in this forum. So check this out, and cringe.

If wages were really as modestly sticky as we estimate from the local level, wages should have fallen at the aggregate level given the large decline in employment. But we don’t see wages falling, so that tells us there must be a labor supply shock in the background.

We also have decomposition for prices. If it were only a demand shock, prices would have fallen. But prices didn’t, so that tells us there’s some productivity shock in the background. So we use our model in this estimated parameter to quantify the relative contributions of the discount rate shock, the productivity/markup shock, and the leisure shock in the aggregate economy. And we find that the discount rate shock could explain a pretty significant share of the decline in employment in the United States during 2008 and 2009. But it explains close to zero of the persistence — why employment remained low from 2010 through 2012. Instead, you have to look at the productivity/markup and labor supply shocks to explain that.

What in hell.

Labor supply shock? So just coincidentally during the Great Recession, the supply of labor decreased leading to aggregate wage stickiness?

No. Just no. How is even possibly to hypothesize that much less publish that in a peer-reviewed journal?

Now on to prices and demand shock. The problem with examining price data is that most consumption goods are compulsory. For instance, you don’t stop buying toothpaste or rice unless you have absolutely no money at all. Demand for most items won’t change much in a modern Western economy even in a recession, so you must choose which goods you examine to learn anything worth learning.

Big ticket items will find purchasing delayed or avoided altogether so that’s where you must turn.

So let’s look at some of that data.

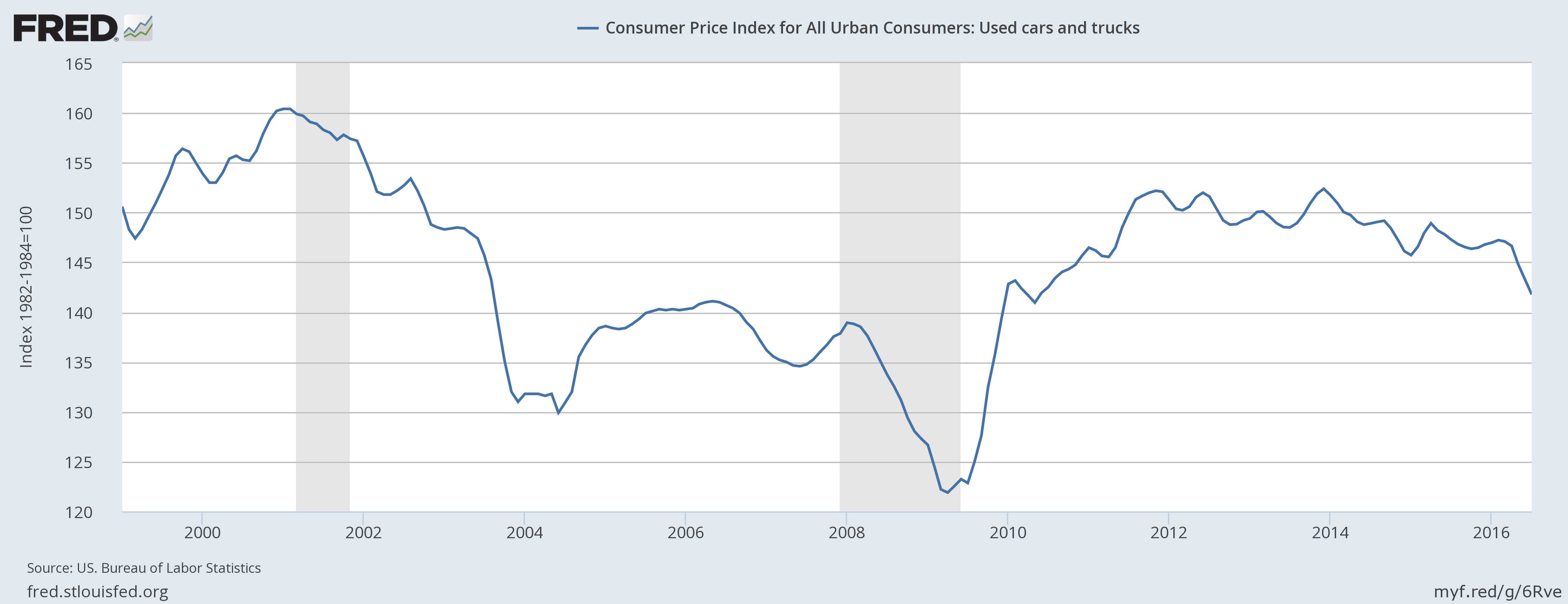

Notice anything about used car prices during the Great Recession? Yeah, me too.

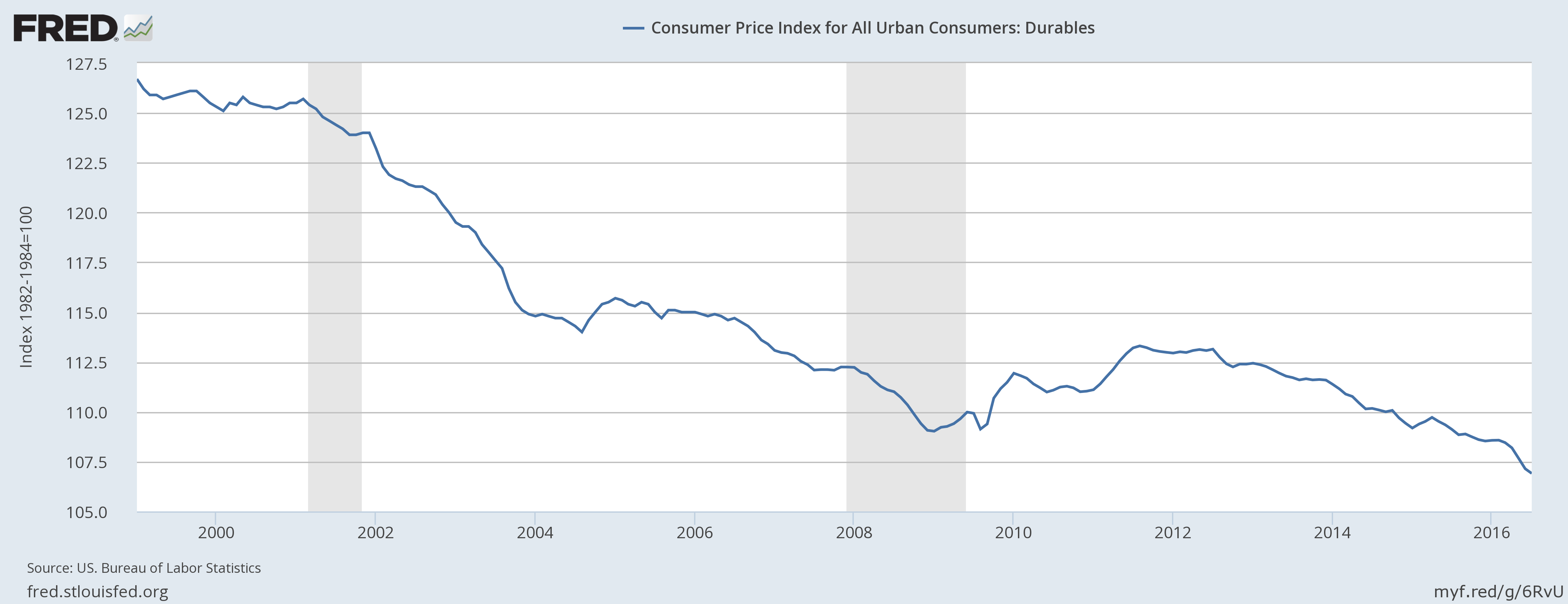

Here’s durable goods (already falling but fell faster during most of the GR).

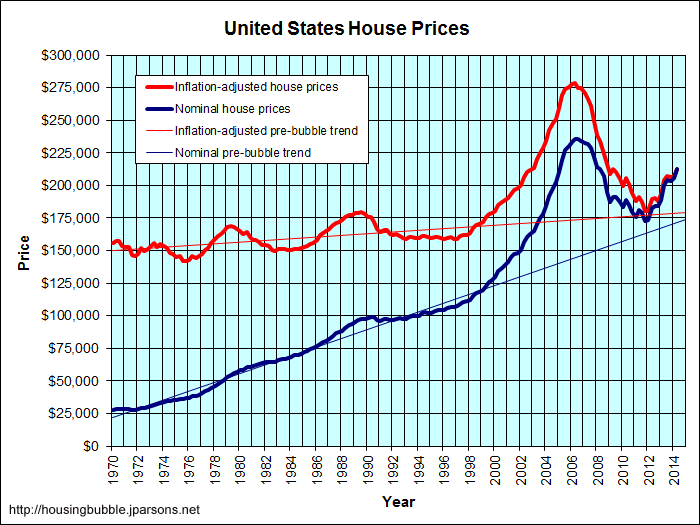

Now let’s check out housing prices (well, we all know the story of that but good to see the graph anyway).

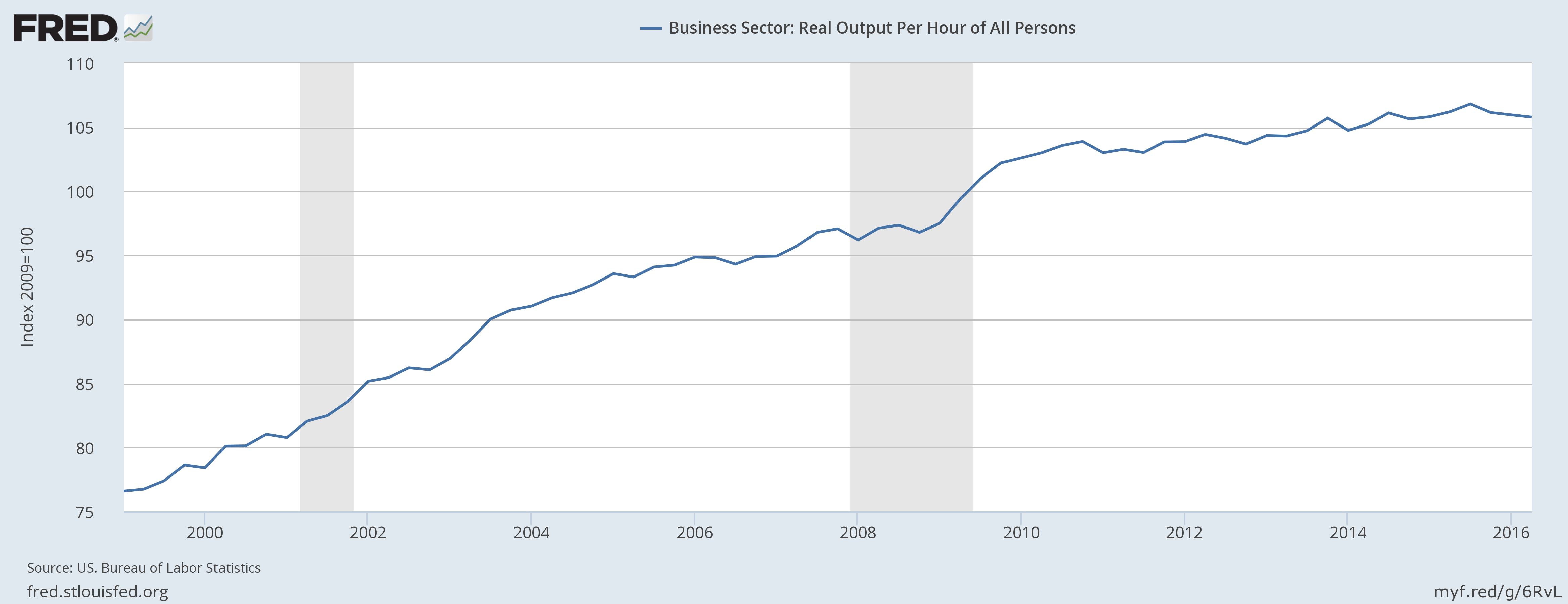

About that productivity shock.

See any productivity shock there? Me either. I see a slight decline (really more of a leveling off) and then a large increase during the late stages of the Great Recession.

I’m so glad I’m not an academic so I can say things like this without being cast out of the order and the council: their paper is bullshit and their model is bullshit, and it only took 20 minutes of data-gathering to prove it.

I’m leaving a comment to myself to chastise myself for bothering to spend that long reading the interview, the paper and then doing the research to refute those fuckwits’ fuckwittery.

I’m guessing this news story was on your radar screen, but I’ll post this link just in case.

Yeah. Heterodox economics is actually losing in academia as far as I can tell. The ruling elites find it (for good reason) threatening, so like parts of science in the Soviet era it’ll be suppressed. Perhaps not as ruthlessly, but just as effectively.

Alas the only thing that is likely to defeat neoliberalism in all its manifestations is collapse.